Financial Accounts

Financial Accounts

RMD Tracking

LeadCenter makes it easy to track contacts, accounts, and tax types that fall under RMDs (Required Minimum Distributions) rules.

What are RMDs?

For more information about RMDs, please refer to the latest IRS publications on irs.gov

Account Tax Types with RMDs

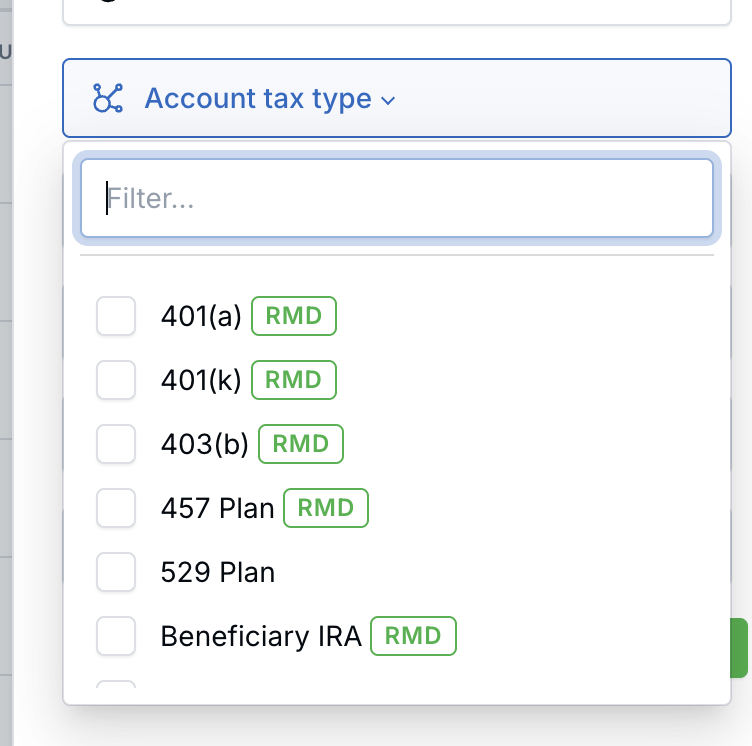

When creating or editing a tax type, turn on the Is RMD required if RMD rules apply to this tax type. This will flag the tax type within an account with RMD, making it easier to identify accounts subject to RMD rules. Click here to edit Account Tax Types. Additionally, when filtering accounts, you can easily identify RMD tax types using the RMD tag, like this:

Flagging an account for RMDs

When creating or editing accounts, use the Meet RMD requirements field. Turn this field on if the client and account meet Required Minimum Distributions (RMDs) rules.

This feature helps you:

- Easily filter RMD accounts in the accounts dashboard and reports.

- Automate triggering RMD processes using workflows.

Flagging contacts for RMDs

Once the Meet RMD requirements field is turned on for any issued account, the following RMD icon will automatically appear on the contact details page:

Additionally, you can apply filters to find all accounts that meet RMD rules.

Using the "RMD Required" Field in Workflows, Email Campaigns, and SMS Campaigns

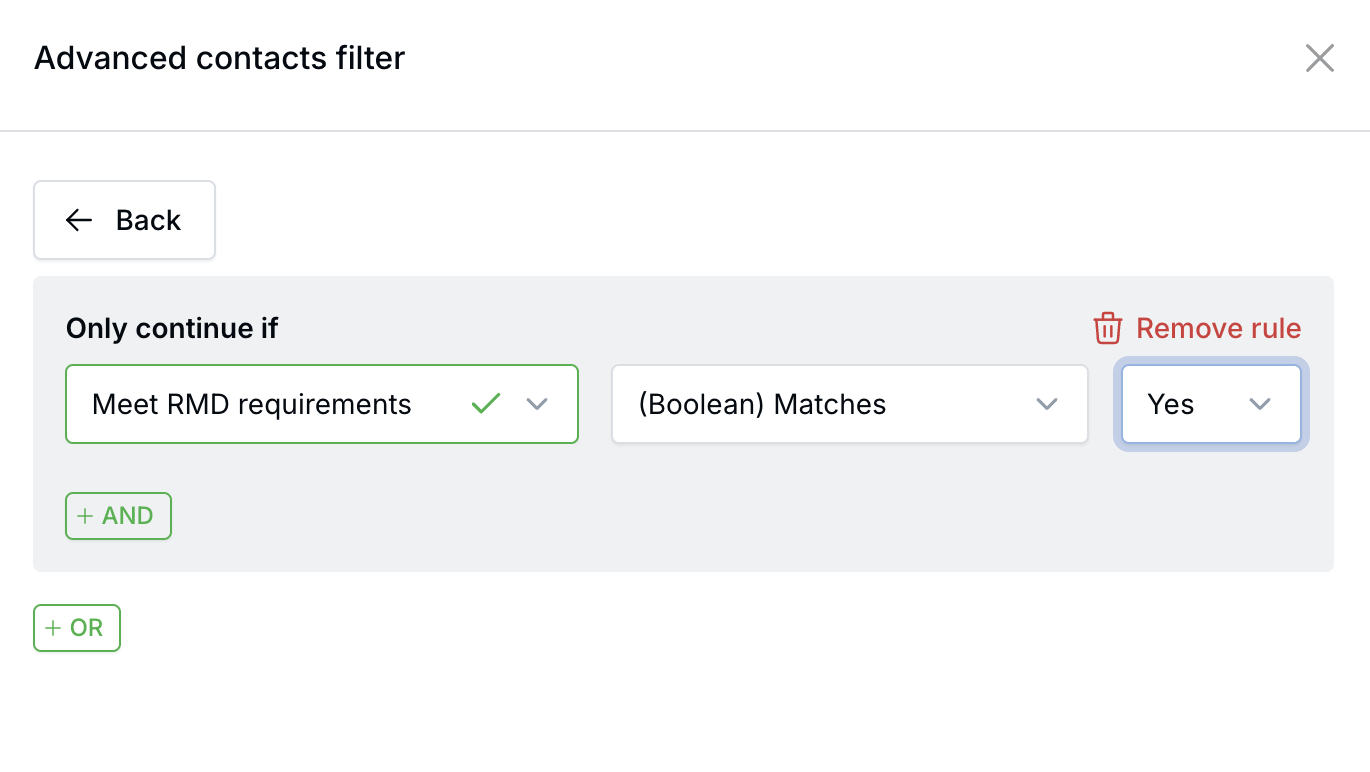

Now, you can use Advanced Contact Filters to filter contacts based on the Meet RMD requirements field. For example, you can create a filter like this:

This allows you to trigger workflows, email campaigns, and SMS campaigns based on RMD eligibility.

Need more help?

If you can’t find the answers you’re looking for, our support specialists are available to answer your questions and troubleshoot if necessary.

-

Phone Call (888) 291-7116. Our main hours are Monday to Friday 7 am-5 pm Central Time.

-

Support Ticket Send your questions and inquiries via email to support@leadcenter.ai. A support ticket will be created and one of our team members will get back to you as quickly as possible.